The Presidential Committee on Tax Policy and Fiscal Reforms is mulling efforts to stop the Nigeria Customs Service and 62 other Ministries, Departments, and Agencies (MDAs) of the Federal Government from collecting direct revenues.

The presidential tax committee said the Federal Inland Revenue Service (FIRS) will now collect revenue for the MDAs.

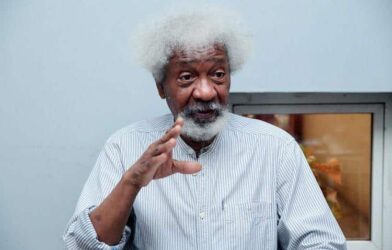

This was disclosed by the Chairman of the Committee, Taiwo Oyedele while speaking on Channels Television’s Sunrise Daily breakfast programme on Wednesday.

Oyedele said, “Ironically, our cost of collection is one of the highest. And the reason for that is that we’ve got all manners of agencies. The Federal Government alone, we have 63 MDAs that were given revenue targets last year, no; actually, in the 2023 budget.

“So, move those revenue collection function to the FIRS. It has two advantages: the cost of collection and efficiency will improve, these guys will focus on their work, and the economy will benefit as a result.”

Giving more clarity, Oyedele, who is a former Fiscal Policy Partner and Africa Tax Leader at PriceWaterhouseCoopers (PwC), said MDAs are not set up to collect revenue on behalf of the federal government, therefore, should focus on their primary responsibilities

He advanced that “If you are Customs, focus on trade facilitation, border protection, and if you are NCC (Nigerian Communications Commission (NCC), just regulate telecommunications. You are not set up to collect revenue.

“It can be your revenue, and someone else can collect it for you. There will be more transparency because you see what is being collected and is accounted for properly. It is also a way of holding ourselves to account as to how we spend the money we collect from the people.”

Speaking further about Nigeria’s tax gap, Otedele submitted, “As of today, we have significant tax gap estimated in the region of 20 trillion or even more naira. If you focus more on the few major taxes – Value Added Tax, Corporate Income Tax, Personal Income Tax, a lot of people are not (tax) compliant, particularly the middle class and the elite, some of them are in the tax net with one or two fingers, you pay a thousand naira as tax when you should have paid N10 million.”

Comments are closed