My younger brother, Emeka who holds a citizenship of one of the most advanced and sophisticated economies in the Western society, came to visit us last year’s Yuletide season.

However, his expectations that he would have seamless monetary transactions to drive his movements from Lagos to Imo State then to Abuja and back to Lagos, turned out to be a nightmare.

Ordinarily, cashless transactions reduce the risks of carrying huge volumes of cash particularly in our clime whereby organised sophisticated crimes are becoming unprecedented. Petty criminals are in operation all around the states also.

But this is not so because of a number of man-made factors which include corruption, bureaucratic bottlenecks and poor or inadequate supervisions in the government circles which consequently unleashes poor quality of infrastructures that ought to be in place and functioning optimally to enable individuals and businesses to carry out their transactions with minimal encumbrances.

So, the arrival in Nigeria of my younger brother fell around and about the last quarter of last year when the governor of Central Bank of Nigeria Godwin Emefiele woke up one morning apparently from the wrong side of his bed and decided that the nation needs to redesign a bulk of her naira notes.

The reason adduced for such a monumental monetary revolutionary initiative dangled between senility and gross lack of logic. Also, the timing of this major redesigning of the National currency happened coincidentally few weeks to the holding of the year 2023 election in Nigeria presumed to be one of the most significant political phenomenon in the annals of Nigeria. This is so because the last eight years of the Muhammadu Buhari’s administration is both nightmarish and abysmally poor.

The February and March 2023 general election especially the February 25th 2023 presidential election is assumed to be a historical moment whereby Nigerians are opportune to change their political destiny by electing a capable, competent, and incorruptible president to turn around the national economy of Nigeria that has already been destroyed by the current Federal administration headed by an erstwhile military despot Major General Muhammadu Buhari.

So questions were asked why the sudden decision to redesign the naira notes and also why do this essential monetary initiative happening around and about at a time of election with all its attendant tensions. Importantly, election season in Nigeria is mostly mirred in conspiracy theories, real violence and all kinds of shenanigans and with the imminent exit of the Central government, the next question demanding an answer is why wait till the eleventh hour to kick-start such a significant economic milestone?

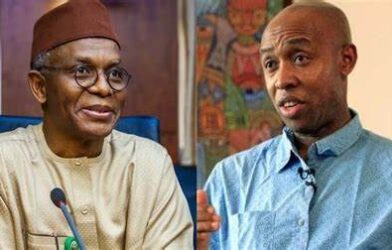

Amidst the cacophony of oppositions to the sudden decision to redesign the naira notes within the electioneering period with all the possibilities of distractions, fell on deaf ears of Godwin Emefiele and President Muhammadu Buhari.

The duo however shot themselves on the leg when they openly politicized the monetary policy of redesigning the naira notes by hiding under the nebulous and outlandish reason that the redesigning policy will stop politicians who had amassed the old naira notes in their hide outs from influencing the outcomes of the election. Nigeria is notorious for votes buying and other corrupt influences that have consistently unleashed the worst sets of Nigerian parasitic politicians to occupy the sensitive political offices. This leg of the excuse for the redesigning of the naira notes is as brainless as it can be.

Emeka therefore met a Country in in apparent dysfunctionality and in a messy situation which climaxed in the unfortunate scenario that depositors have their money trapped in the banks because the government asked them to submit their old naira notes so as to get new notes.

Depositors are still in pains and indeed youths all across the Country started burning down banks because they are unable to get back their deposits. The deposit banks are blaming the CBN for not supplying enough of the new naira notes whereas the CBN is throwing back the blame at the banks whose managers hoard the new notes and are auctioning same to the highest bidders who ironically are the same political office seekers for which the CBN has redesigned the naira notes to pre-empt them from buying voters.

Also the CBN had argued that a lot of the old notes where hidden by the rich elites and so the redesigning policy was amongst other things meant to force those hiding the old naira notes to return them to the banking system. In what appears foolish, the economic and Financial Crimes Commission then went all out to fill up the air waves and the news pages with the warning that it was on the lookout to catch the rich people who had hidden huge cash in their houses.

So what exactly is the aim of the scare mongering by the EFCC when the intention of the new monetary policy is to make those keeping their monies at home to retrieve and return them to the banking system? This is why it does not make any economic sense coupled with the wrong timing. If the government has capacity, it should know the politicians who want to buy votes and then arrest and prosecute them. Why introduce new notes, collect back all the naira notes with most especially the poor masses who need small cash for their daily transactions, and then the same government deliberately failed to carry out the obligation of saturating the banking system with the new notes? Rather what we keep reading in the media is the throwing around of blames by the CBN to all kinds of people. President Muhammadu Buhari is not left out in the vicious circle of blame game with no solution in place concretely.

As aforementioned, Mr. Godwin Emefiele, the Governor of the Central Bank of Nigeria (CBN) accused some unnamed political leaders of buying and hoarding naira notes as the controversial cash swap policy of the apex bank subjects Nigerians to hardship.

In October 2022, the CBN announced its plan to redesign the N200, N500, and N1000 notes to address insecurity and vote-buying ahead of the 2023 general elections.

But since the CBN announced January 31, 2023, as the deadline for the redesigned notes to cease as legal tender, Nigerians have been struggling to get the new notes.

Due to the scarcity of the redesigned notes and its attendant crisis, the CBN shifted the deadline for the expiration of the old notes to Friday, February 10, 2023, to allow Nigerians to take their old note to banks in exchange for the new ones.

Sadly, the situation worsened as commercial banks were accused of hoarding the new notes while currency racketeers and POS operators sell the new notes in black markets.

Speaking on the matter on Tuesday, February 14, 2023, Emefiele attributed the scarcity of the new notes to hoarding.

The CBN governor said some Nigerian leaders have bought the available new notes and stored them.

“Some of our leaders are buying the new notes and storing them for whatever purpose and I will not expand further on that,” he said.

The cash swap policy has currently thrown Nigerians into a serious state of confusion as traders, fuel stations and banks reject the old naira notes while the new notes remain scarce.

Recall that after some governor dragged the CBN to court over the controversial cash swap policy, the Supreme Court issued an interim injunction asking the CBN to suspend the February 10 deadline for the old notes.

As Nigerians awaited the court’s pronouncement on the policy on Wednesday, February, February 15, 2023, the apex court adjourned the hearing of the suit to Wednesday, February 22, 2023.

However, the court stated that its earlier judgement on the matter subsisted, which means Nigerians can continue spending the old notes till next week.

This policy if redesigning naira notes and tightening the noose unnecessarily on the redistribution of the new naira notes has adverse and eventually deadly consequences on mostly the poor Nigeria who are in huge number.

In its 2022 Multidimensional Poverty Index Survey released in Abuja recently the National Bureau of Statistics (NBS) said the figure represents 63 per cent of the nation’s population.

It added that the poverty index is mostly experienced in rural areas especially in the north with women and children being the most affected.

The media reports that the survey was conducted by the NBS, the National Social Safety-Nets Coordinating Office (NASSCO), the United Nations Development Programme (UNDP), the United Nations Children’s Fund (UNICEF), and the Oxford Poverty and Human Development Initiative (OPHI).

It was gathered that the measure used to calculate the figure was based on Multidimensional Poverty Index (MPI) with five components of health, living standard, education, security, and unemployment.

According to the survey, over 50 per cent of children across the country are affected by poverty.

In his remarks, the Statistician-General of the Federation, Mr Adeyemi Adeniran, noted that 56,610 households were surveyed and areas such as health, education, living standards, food security, water reliability, underemployment, security shocks, and school attendance were considered.

While the multidimensional poverty index stood at 27 per cent in Ondo State, the figure is estimated at 90 percent in Sokoto state.

The United Kingdom has issued another travel advice to its citizens in Nigeria, the second in four months.

In the information updated on not long after the publication on the figure of absolutely poor Nigerians, the Foreign, Commonwealth & Development Office, FCDO, warned against areas where there are banks and ATMs.

It noted that the Central Bank of Nigeria’s redesigning and issue of new N200, N500 and N1000 notes has led to shortages of cash.

There have been outbreaks of violence in some Southern states as a result of cash shortages, with a risk of other urban areas being impacted across the country.

Following the rapidly spreading violence, the United Kingdom issued another travel advice to its citizens in Nigeria, the second in four months.

In the information updated on Wednesday, the Foreign, Commonwealth & Development Office, FCDO, warned against areas where there are banks and ATMs.

It noted that the Central Bank of Nigeria’s redesigning and issue of new N200, N500 and N1000 notes has led to shortages of cash.

Citizens were encouraged to ensure notes provided by currency exchange vendors will be valid for the duration of their travel to Nigeria.

There have been outbreaks of violence in some Southern states as a result of cash shortages, with a risk of other urban areas being impacted across the country.

President Muhammadu Buhari made a national broadcast reinstating the banned N200 naira note in his attempt to douse tensions. But the scarcity of new naira notes and even the reinstated N200 notes are very scarce. This is why it is wrong to mix up economic or monetary policies with the muddied waters of dirty politics as President Muhammadu Buhari’s administration has done.

Emmanuel Onwubiko Writes From Abuja

Comments are closed