Nigeria has some of the most successful banks and hotels of international standards, no doubt.

But these big corporate bodies are not known for how good they are as corporate citizens that are obliged to deliver certain responsible services back to the communities where they operate.

In 2018, the National Assembly passed the bill known as Corporate Social Responsibility (Special Provision, etc) Bill of 2015. I have searched through the Internet and asked questions regarding the status of that bill, but most people are unaware of it.

Also, I’m not too sure, if Nigeria as a federation has a mechanism for fishing out those companies that are making huge profits after taxes yearly but who are nevertheless found wanting in the area of discharging their expected corporate Social Responsibility services to the citizens. If we do have such, we would have heard them loud and clear in the media because government agencies make more noise in the media than carry out their mandates as expected of them in compliance with the statute setting them up.

Why it is important to have this transparent methodology of ascertaining the extant corporate Social Responsibility (CSR) status of corporate institutions in the Country is because of the presence in the Country of a huge body of very poor people who due to no fault of theirs, have found themselves within the neglected margins of the society or rather they are what philosophers call Hoi-polloi. Regrettably, the number of young people in this poverty bracket is huge.

Now let us read about some of these giant businesses in Nigeria that keep churning out unimaginable profits yearly but whose CSR profiles are nothing to write home about.

Recently, Zenith Bank Plc said it grew its gross earnings by 24 per cent from N765.6n as of the end of 2021 financial period to N945.5bn in the corresponding period of 2022.

The bank disclosed this in a statement on Tuesday last week on its audited results for the year ending December 31, 2022, titled ‘Zenith Bank grows gross earnings by 24 per cent to N945.5bn in 2022’.

As part of its commitment to shareholders, the bank also announced a proposed final dividend payout of N2.90 per share, bringing the total dividend to N3.20 per share.

Despite the persistent challenging macroeconomic environment and headwinds, the statement said the bank achieved double-digit growth.

It stated that, “According to the audited financial results for the 2022 financial year presented to the Nigerian Exchange, the double-digit growth in gross earnings was driven by a 26 per cent year-on-year growth in interest income from N427.6bn to N540.2bn and a 23 per cent year-on-year growth in non-interest income from N309bn to N381bn.

“Profit before tax also grew by two per cent from N280.4bn to N284.7bn in the current year. The increase in profit before tax was due to the significant growth in all the income lines.”

According to the bank, impairments grew by 107 per cent from N59.9bn to N124.2bn, while interest expense grew by 63 per cent YoY from N106.8bn to N173.5bn respectively.

Customer deposits increased by 39 per cent, growing from N6.47tn in the previous year to N8.98tn in the current year.

The growth in customer deposits came from all products and deposit segments (corporate and retail), consolidating the bank’s market leadership and indicating customers’ trust.

The continued elevated yield environment positively impacted the bank’s net-interest-margin, which grew from 6.7 per cent to 7.2 per cent, due to an effective repricing of interest-bearing assets.

Operating expenses grew by 17 per cent YoY, but growth remained below the inflation rate.

According to the bank, its total assets increased by 30 per cent, growing from N9.45tn in 2021 to N12.29tn, mainly driven by growth in customer deposits.

With the steady and continued recovery in economic activities, the Group grew its gross loans by 20 per cent, from N3.5tn in 2021 to N4.1tn in 2022, which increased the non-performing loan ratio modestly from 4.2 per cent to 4.3 per cent YoY.

The capital adequacy ratio decreased from 21 per cent to 19 per cent, while the liquidity ratio improved from 71.2 per cent to 75 per cent. Both prudential ratios were above regulatory thresholds.

“In 2023, the Group intends to expand its frontiers as it also reorganises into a holding company structure, adding new verticals to its businesses and growing in all its chosen markets, both locally and internationally,” the statement said. So what is the bank doing to reduce poverty in Nigeria? What is the bank doing to create skills and vocational capacities amongst millions of citizens in Nigeria?

Then comes one of the most successful hotels in Nigeria that keeps announcing huge profits all the times but with very little to show by way of CSR. This hotel is known as Transcorp Hilton hotels.

Managing Director/Chief Executive Officer, Transcorp Hotel, Mrs. Dupe Olusola has said the company in 2023 aimed at deepening its holdings as the foremost hospitality brand in Africa through innovation and technology.

Speaking on AriseTV recently, she said that the company has over 5,000 listings of hotels and accommodation apartments across 30 states in Nigeria.

She disclosed that the company is excited about 3,500 to 5,000-capacity event centre expected to be launched in the first quarter of 2024.

“This is actually to be located in Abuja. We want to continue to expand our footprint. We are expanding to Lagos and this is going to be a phenomenal five-star hotel that offers accommodation as well as event space, among others,” she said.

On the result and accounts for the period ended December 31, 2022, she said the performance was fantastic and it comes on the back heel of the determination and dedication of her team and board of directors.

According to her, “The board and management also supported in ensuring that we achieved these numbers. We had to be innovative, invest in technology and stepped outside the box, and diversify the business segments that we have.

“We enrich it with the introduction of leisure, offering different experiences to all our guests. It has been a lot of hard work. The team has been so committed and consistent in ensuring that we constantly innovating and introducing new things. It is about us sustaining these figures and that is the reason we are doing so much more.

“We checked our eyes on the bottom line. We were so focused on driving revenue but not losing sight of actually delivering exceptional customer experience to all our guests. We did not comprise about giving our customers exceptional experiences.

“It was about innovation, offering new value and experiences. All our outlets were key in the revenue drive of Transcorp Hotels. It was not about the rooms but the added value. We also ensure we kept an eye on the cost and run the business efficiently.”

Transcorp Hotels reported profit before tax (PBT) of N4.5 billion in its financial results for full year 2022, representing an increase of 172 per cent increase year-on-year from N1.7billion reported 2021.

The hospitality subsidiary of Transcorp Group also reported a 47 per cent growth in revenue to N31.4 billion in 2022 from N21.4 billion the previous year and a N2.6 billion profit after tax.

“The growth in profit after tax was a sign for us to reward our shareholders for their commitment in us.

“Last year, we did N716million at N0.70. This year we did N1.33billion at N0.13 per share as a dividend payout to shareholders. So, you can imagine the atmosphere at the AGM,” she speaks on the dividend reward to shareholders.

On competition, she said, “We compete with ourselves beyond the external competitions. First, we look at what is happening in the local and international industries. We always want to improve from where we are coming from.

“We do not compromise on standards and our brand standards really important. From our guests to amenities, and when you come into the hotel, these are key.

“We see competition coming but we are always ready. We have won several awards that indicate we do not comprise everything we do. We are consistently innovating, and investing in technology. We also invest significantly in our staff as well.

The hotel said nothing about CSR. These hotels and banks are generating massive and humongous amount of profits from their clients in Nigeria who are well to do, but the other section of Nigerians who are too poor to even obtain without hassles, two square meals daily, are hungry, helplessly hopeless with none of these profitable businesses putting down some amount of money to create skills and Employment opportunities for these poor masses. This is a crying shame! Aliko Dangote runs a foundation but it is not so open to the knowledge of many people.

Yesterday, the special Adviser to President Muhammadu Buhari on Social Investment, Maryam Uwais, said that elected officials tend to focus more on infrastructure while in office and neglect other sectors, especially education.

Let me say a little about a peculiar charisteristic of officials of this administration.

This government talks too much and does so little. This Special Adviser speaking about the increasing population of out of school kids has been in this federal government under President Muhammadu Buhari’s charge, yet the population of poor kids who are not in schools has doubled. Now we have up to 12 million kids that are not in any form of schooling.

According to her, this has impacted negatively on education and contributed to the increase in the number of out-of-school children in the country.

While noting, however, that infrastructure was critical to the development of the country, Uwais said other national issues, such as poverty, and education also needed attention and encouragement.

Uwais, who made the observation in an interview on Channel Television’s breakfast programme, Sunrise Daily yesterday, spoke against the backdrop of data from the United Nations Education Fund, UNICEF, which put out-of-school children’s figure in the country at over 20 million, though the federal government claimed a much lower figure.

Noting that the politics of addressing the rate of out-of-school children was not encouraging.

She said: “So, there are many reasons and I think the government is trying to put all these together.

”We should be more holistic about how we handle these issues. I agree with you that the numbers are large but there are many issues as I said and even the structure of the issues.

“When elected officers get into government, they are more interested in seeing what is tangible, pointing at something and saying this is my legacy. When you budget for education at the state level, most of the money tends to go for infrastructure. But there are other issues that are more important and I am not downplaying infrastructure.

“We need more infrastructure; we need to look at the poverty issues, the underlining issues that compound the problem need to be addressed.”

She said despite all government interventions so far, there seemed to be very little progress recorded regarding the number of children recorded out of school.

“We have a population that is growing much faster than our economy and we are not really targeting those issues that are increasing the numbers, there are so many disparities. We need to be more strategic about what it is that is causing these numbers,” she said. Too much talk but no action with a lot of funds voted and released for social advancement programmes under the auspices of the ministry for humanitarian affairs and disaster management. But this office for humanitarian affairs is a cesspool of epidemic corruption.

So why is CSR not an issue in the Country with the largest army of poor people? The question boils down to weak institutions or the lack of a clearly defined institutional platform for the enforcement of CSR as a mandate or legal obligations of companies making profits in Nigeria. So why does government extend some concessions like tax rebates to some of these businesses but yet they are not corporately and socially responsible? So what is this concept called CSR?

Researched work from experts say corporate Social Responsibility is a management concept whereby companies integrate social and environmental concerns in their business operations and interactions with their stakeholders. CSR is generally understood as being the way through which a company achieves a balance of economic, environmental and social imperatives (“Triple-Bottom-Line- Approach”), while at the same time addressing the expectations of shareholders and stakeholders. In this sense it is important to draw a distinction between CSR, which can be a strategic business management concept, and charity, sponsorships or philanthropy. Even though the latter can also make a valuable contribution to poverty reduction, will directly enhance the reputation of a company and strengthen its brand, the concept of CSR clearly goes beyond that.

Promoting the uptake of CSR amongst SMEs requires approaches that fit the respective needs and capacities of these businesses, and do not adversely affect their economic viability. UNIDO based its CSR programme on the Triple Bottom Line (TBL) Approach, which has proven to be a successful tool for SMEs in the developing countries to assist them in meeting social and environmental standards without compromising their competitiveness. The TBL approach is used as a framework for measuring and reporting corporate performance against economic, social and environmental performance. It is an attempt to align private enterprises to the goal of sustainable global development by providing them with a more comprehensive set of working objectives than just profit alone. The perspective taken is that for an organization to be sustainable, it must be financially secure, minimize (or ideally eliminate) its negative environmental impacts and act in conformity with societal expectations.

Key CSR issues: environmental management, eco-efficiency, responsible sourcing, stakeholder engagement, labour standards and working conditions, employee and community relations, social equity, gender balance, human rights, good governance, and anti-corruption measures.

A properly implemented CSR concept can bring along a variety of competitive advantages, such as enhanced access to capital and markets, increased sales and profits, operational cost savings, improved productivity and quality, efficient human resource base, improved brand image and reputation, enhanced customer loyalty, better decision making and risk management processes. These opinions of experts are very well understood. So why are there no institutional checks and balances for ensuring that businesses meet up with the demands of the CSR?

The simple reason is that even when there is a law making CSR mandatory, enforcement is often a challenge due to endemic corruption. I think we should as a nation pay close attention to CSR given the big profits that big banks, hotels and many other thriving businesses make every year.

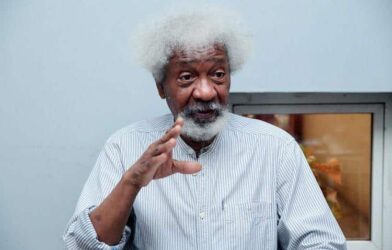

*EMMANUEL ONWUBIKO is head of the HUMAN RIGHTS WRITERS ASSOCIATION OF NIGERIA and was NATIONAL COMMISSIONER OF THE NATIONAL HUMAN RIGHTS COMMISSION OF NIGERIA.

Comments are closed