Members of staff of popular financial institution, LAPO Micro Finance Bank (MFB) have kicked against the bank management’s move to increase staff salaries by only 25% and 12.5% after 7 years of alleged stagnant pay.

Exclusive reports obtained by Kemi Filani reveals that the last time LAPO MFB’s staff‘s salaries were reviewed was in 2016, and their staff don’t allegedly get the annual (step) increment other organisations/institutions enjoy. “Our salaries have been stagnant since 2016″ after they reviewed it upwards by 15%. The management only reviews staff salaries as at will. It can take 10 or 7 years which is not supposed to be so.” A staff who pleaded anonymity told Kemi Filani.

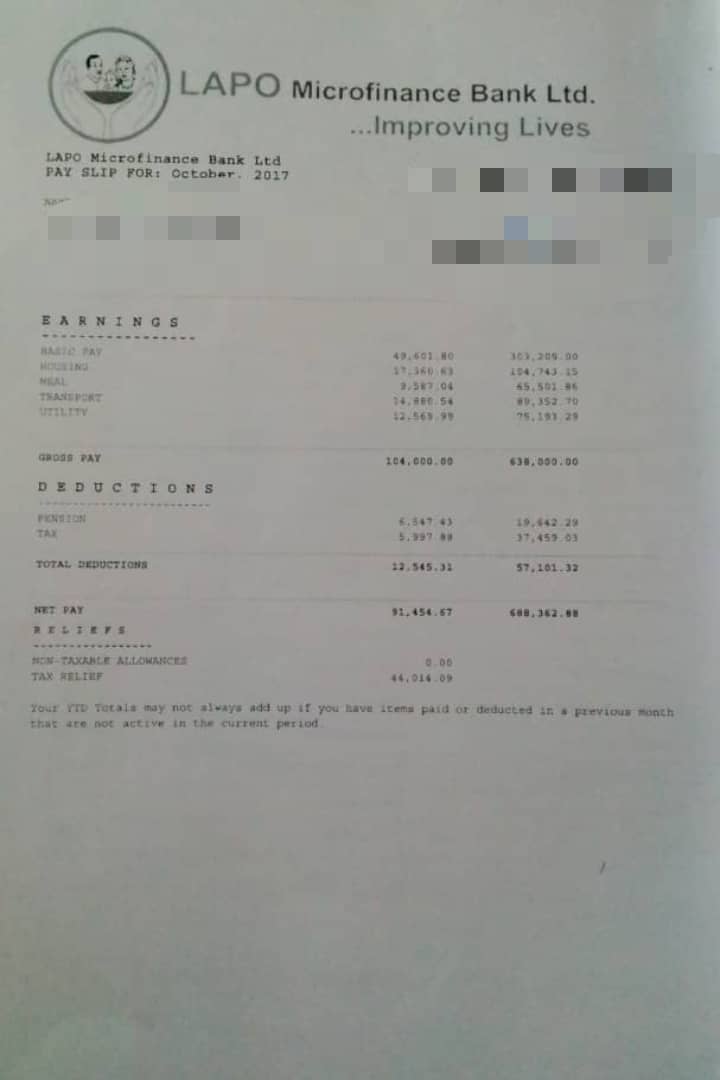

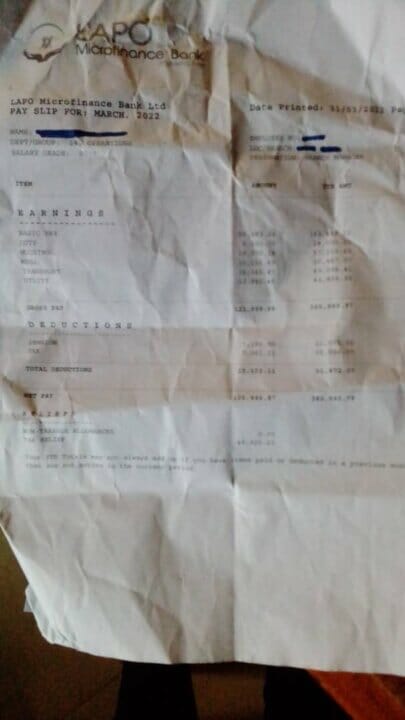

It was gathered that as at 2016, before the 15% review, graduate (BSC/HND) staff (CSOs) earned a net salary of seventy five thousand, seven hundred and fifty naira, eighty six kobo (N75,750.86K), and after the review, their net pay became ninety eight thousand, three hundred and fifty six naira, forty one kobo (N98,356.41K). While Branch Managers (BM) get same salary, but an extra eight thousand naira (N8,000) as duty allowances.

It was gathered that after seven years of stagnant pay, the bank management decided to increase staff salaries by 25% for Junior staff (Graduate CSO, BM, Auditors and AM) and 12.5% for senior staff (Zonal managers – ZM).

“We have had stagnant salaries for years with no one being able to complain. If you do, they will threaten to transfer you to another state, far away from your family. After we were able to complain, they decided to increase it by 25% for Junior staff and 12.5% for senior staff” another staff whispered to Kemi FIlani.

The staff continued, “We have told them that due to the current economic situation in the country, a 25% increase after 7 years wouldn’t make sense. A graduate working for over 10 years and up till now, my net pay is not up to 100K. I can not complain or renegotiate my pay, they only decide on when to review it, which isn’t a standard practice anywhere.”

“We have begged them to at least review CSO salaries to 135K, BMs to 160K and so on, but they refused. Over the years, everything have increased exponentially and become more expensive; transportation, food, school fees, house rent etc. But our salaries have been stagnant or move like snail” another staff who pleaded anonymity cried out.

“Also, they have refused to pay us institutional bonus since 2020. They claim that CBN has not updated their financial records. We work hard for these people. We trek looking for customers and clients, but they treat us like rags and pay us peanuts. They will disengage staff without query or warning letter , suspension letter, they will just disengage staff like that, which is not the standard anywhere” another staff added.

Kemi FIlani News reached out to the Ed Operation of LAPO MFB, Faith Ojo, however, she chose not to respond as at the time of writing this report.

A message was also sent to Oluremi Akande, Head, Communications & Branding of the institution, but no response was received as at the time of filling this report.

Recall that in 2022, LAPO MFB was nominated and won the “Microfinance Bank of the Year” 2022 award in the 10th edition of the Businessday Banks’ and other Financial Institutions’ (BAFI) Awards event.

In a press release, Oluremi Akande, Head, Communications & Branding, said “LAPO MfB has won this award category for the 9th consecutive time; a recognition of LAPO’s industry leadership and its consistency in the delivery of its core mandate of social and economic empowerment of members of low-income households, through the provision of responsive financial services and social interventions impacting lives and communities in a sustainable manner”.

Comments are closed